Source: The East African, 31st January 2024

Tag Archives: Mining

1. Metals

2. Oil shale

3. Gem stones, Limestone, Dimension stone

4. Rock salt

5. Potash

6. Gravel

7. Clay

Mapping Africa’s natural resources Nearly half the world’s gold and one-third of all minerals are in Africa

Beneath the surface of Africa lies a wealth of mineral resources of enormous value. In 2019, the continent produced almost 1 billion tonnes of minerals worth $406bn.

According to the United Nations, Africa is home to about 30 percent of the world’s mineral reserves, 12 percent of the world’s oil and 8 percent of the world’s natural gas reserves.

The continent also holds 40 percent of the world’s gold and up to 90 percent of its chromium and platinum – both valuable metals.

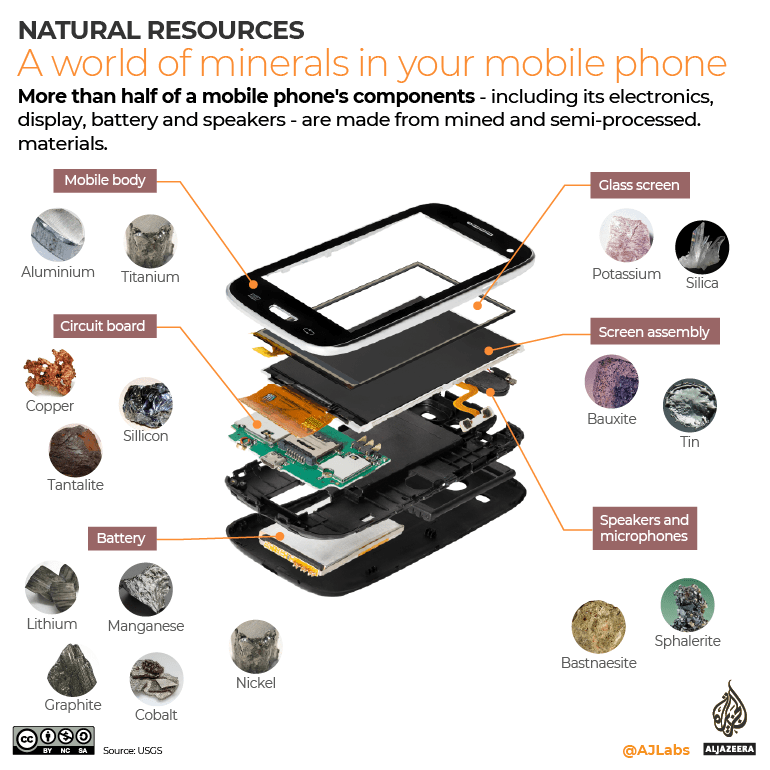

A world of minerals in your mobile phone

Most of the electronics we use today are based on a number of minerals – from aluminium to zinc.

In 2021, some 1.5 billion smartphones were sold around the world – up from 122 million units in 2007. As of 2020, nearly four in five (78 percent) people own a smartphone.

More than half of a mobile phone’s components – including its electronics, display, battery and speakers – are made from mined and semi-processed materials.

Lithium and cobalt are some of the key metals used to produce batteries. In 2019, about 63 percent of the world’s cobalt production came from the Democratic Republic of the Congo.

Tantalum is another metal used in electronic equipment. Tantalum capacitors are found in mobile phones, laptops and in a variety of automotive electronics. The DRC and Rwanda are the world’s largest producers of tantalum. Together they produce half of the world’s tantalum.

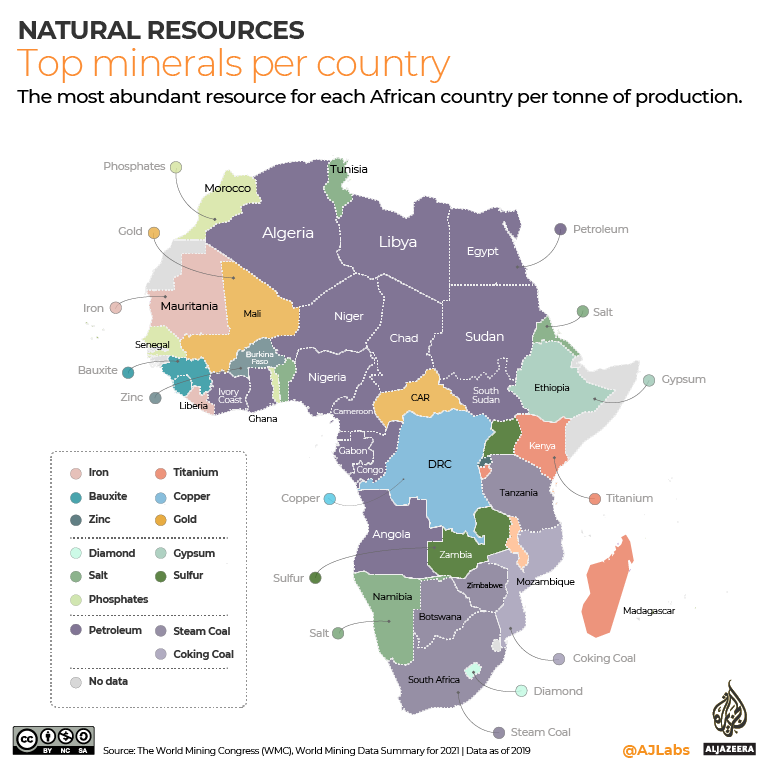

Top minerals per country

Petroleum and coal are among the most abundant minerals for 22 out of Africa’s 54 countries. As of 2019, Nigeria produced most of the continent’s petroleum (25 percent), followed by Angola (17 percent), and Algeria (16 percent).

Metals including gold, iron, titanium, zinc and copper are the top produced minerals for 11 countries. Ghana is the continent’s largest producer of gold, followed by South Africa and Mali.

Industrial minerals such as diamonds, gypsum, salt, sulphur and phosphates were the main commodity for 13 African countries. The DRC is Africa’s largest industrial diamond producer, followed by Botswana and South Africa. Botswana ranks number one in Africa for the production of gem-quality diamonds – used for jewellery.

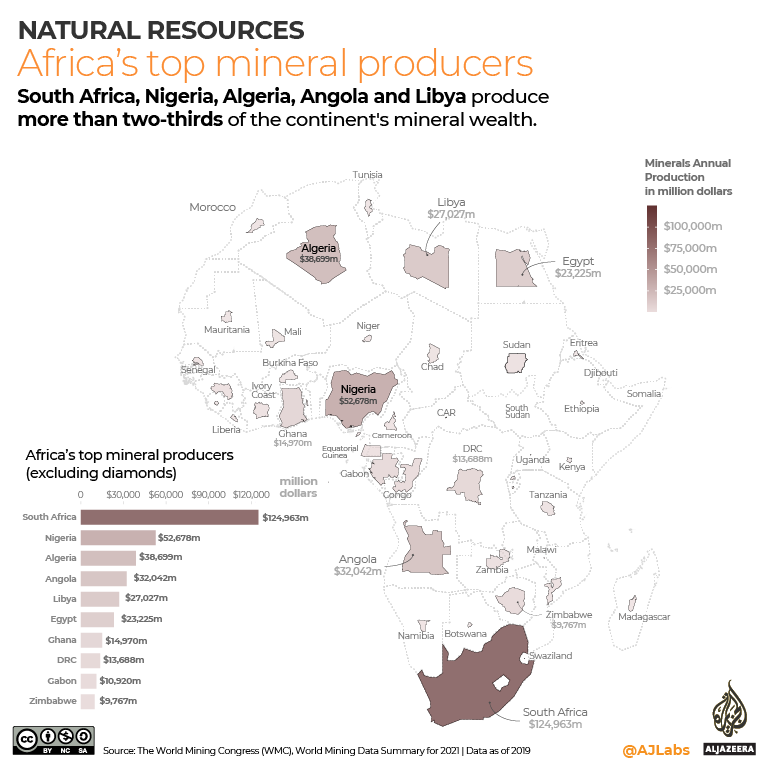

Mineral wealth

At $125bn per year, South Africa generates the most money from its mineral resources. Nigeria comes in second with $53bn per year, followed by Algeria ($39bn) Angola ($32bn) and Libya ($27bn).

These five countries produced more than two-thirds of the continent’s mineral wealth.

The world’s minerals

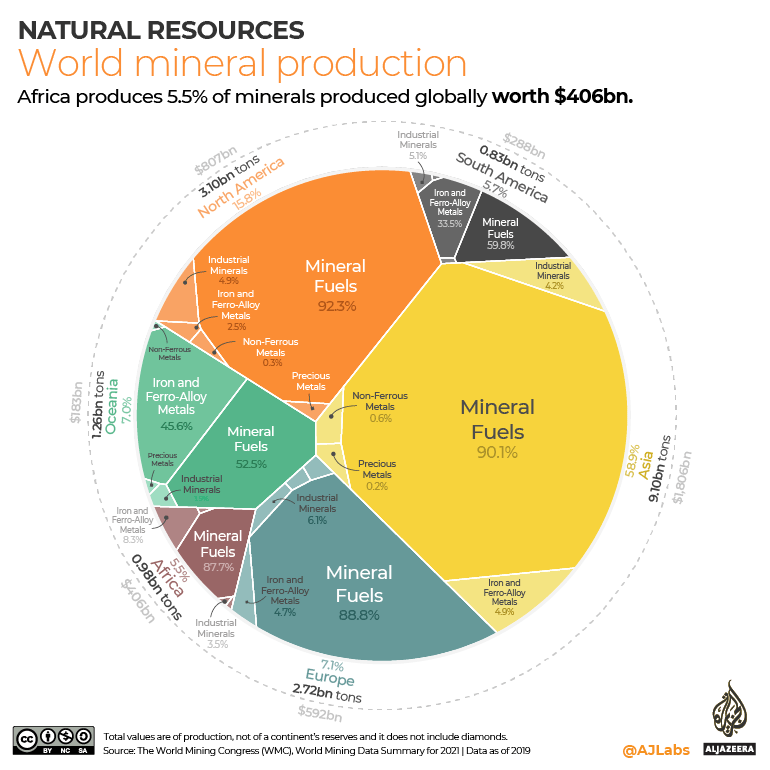

According to The World Mining Congress (pdf), the world extracted some 17.9 billion tonnes of minerals in 2019.

Asia was the largest producer, accounting for 59 percent of the world’s total production valued at $1.8 trillion. North America was second with 16 percent, followed by Europe at 7 percent.

Africa produced about 5.5 percent of the world’s minerals worth some $406bn.

Source: Al Jazeera, 15th February 2022

DRC, South Africa, Botswana… Who has the greatest potential in critical minerals?

Zimbabwe has one of the world’s largest reserves of lithium; treatment plant in Goromonzi, in the country’s north-east. (© Montage JA; Tsvangirayi Mukwazhi/AP/SIPA)

Rich in minerals and strategically located, in theory the African continent has what it takes to play a key role in the ongoing energy transition, but the reality is more complex.

“There is no chance of making the energy transition without Africa,” Robert Friedland, the founder of Ivanhoe Mines, who discovered the Kamoa-Kakula copper deposit in Democratic Republic of Congo (DRC), told the London Indaba conference on mineral resources, energy and mining in June last year.

Indeed, decisive resources for a low-carbon economy are abundant in Africa. The continent’s production of metals used in the manufacture of batteries, solar panels, wind turbines and other electrical networks is impressive.

The Democratic Republic of Congo (DRC) is the leading producer of cobalt, while South Africa is in pole position for platinum and manganese.

As a whole, the continent accounts for more than half the world’s production of these three minerals.

Source: African Report, 18th January 2024

Top 10 business risks and opportunities for mining and metals in 2024

Top miners continue to make progress on a range of ESG, climate change and license to operate risks but are under pressure to do even more.

- ESG is attracting more scrutiny from investors and the community. Better use of data and a focus on net-positive impact can help meet growing expectations.

- Capital rises to #2, as the mining sector grapples to fund the expansions required to meet increasing demand for minerals crucial to the energy transition

- Cybersecurity is becoming a bigger issue as the pace of digital transformation accelerates across the sector.

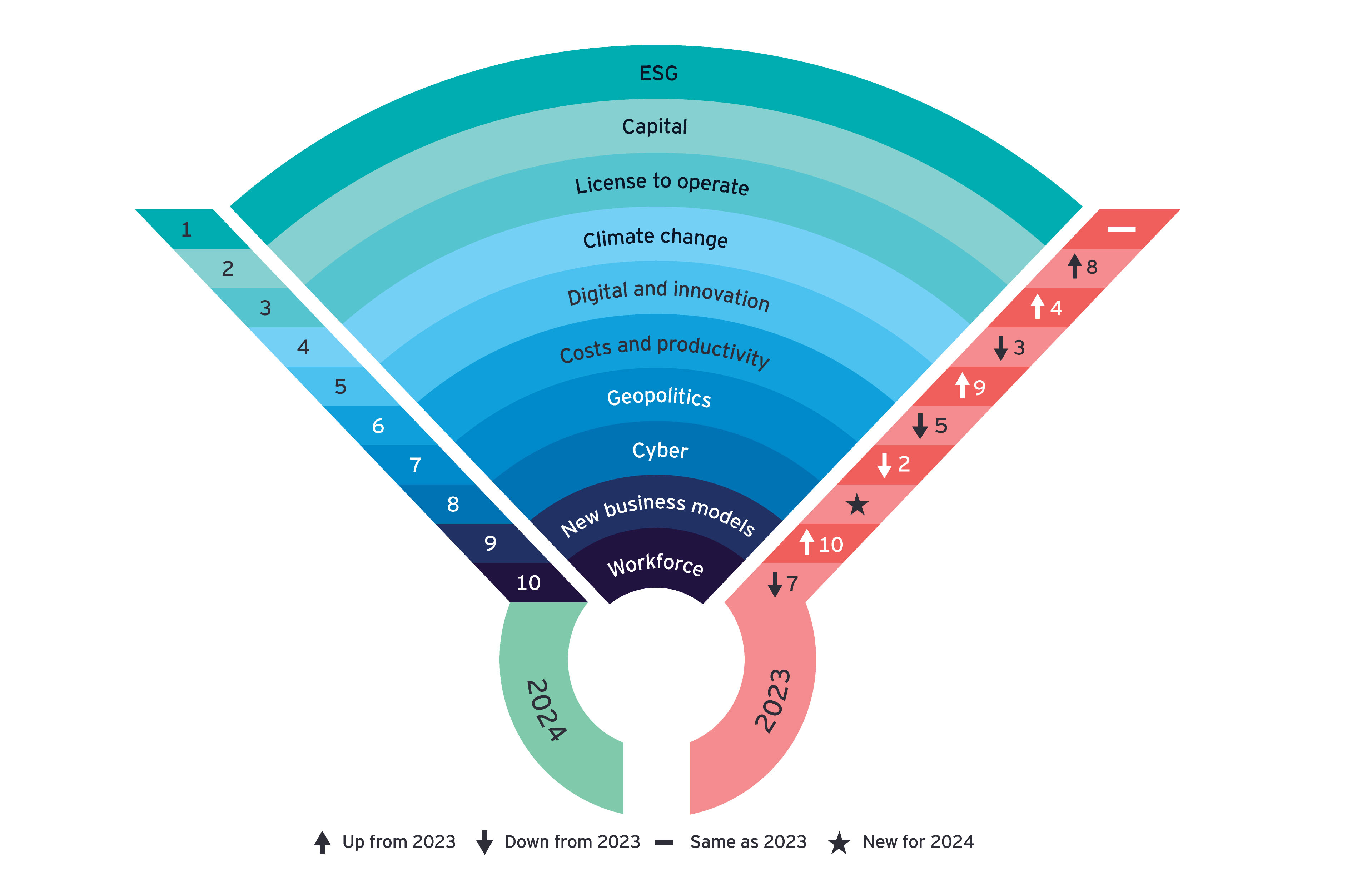

This year’s ranking highlights the complex operating environment miners will face in 2024. Challenges will be numerous but history proves the resilience and the inventiveness of this sector. We expect to see more innovation, collaboration and agility over the next 12 months as mining and metals companies embrace the upside of change. At first glance, the 2024 ranking of the top business risks and opportunities in mining and metals (pdf) doesn’t differ too much from the last couple of years. But while some issues are clearly becoming long-term priorities — particularly ESG and license to operate — others reflect new challenges in the sector.

We see a number of key themes playing out:

Expectations of investors and stakeholders have been underestimated and continue to increase

According to our survey respondents, scrutiny from all stakeholder groups is increasing, particularly around ESG issues. With these expectations anticipated to continue, miners will need to balance ESG priorities with other business goals, including productivity. Many are focused on achieving net- positive impact across a number of ESG factors, with significant benefits for those that get it right, including improved access to capital, a healthier talent pipeline and stronger license to operate [LTO].

The pace of change has accelerated

Capital has moved up in the ranking as the sector competes for investment and incentives to accelerate exploration and development of minerals and metals vital to the energy transition. We’re seeing a shift from a short-term focus on returns to a long-term view of value, encouraged by recognition that longer-term investment horizons are required to meet 2050 net-zero goals.

Inflationary pressure has fast-tracked technology development, as miners focus on digital tools that can accelerate productivity. The pace of digital transformation is highlighting the importance of cybersecurity, which is new to the ranking this year. Supply constraints are a catalyst for consideration of circular economy principles, with miners more conscious of minimizing waste.

Risks today are highly complex, interlinked and impact each other

Executives say they have a better understanding of sustainability issues — but that they cannot tackle all areas at once. With ESG becoming more complex and interlinked, addressing them requires an approach that thinks beyond meeting regulation and controlling costs. Instead, leaders need assurance that investments in one area will add genuine value rather than cause problems elsewhere. In-depth scenario planning can help guide prioritization, identify potential trade-offs and help miners create real, long-term positive impact.

Building trust and articulating value can evolve the sector’s brand

When trust is an issue, transparency is key. Miners need to get better at articulating the nonfinancial value they bring to communities and investors, beyond merely meeting regulatory expectations. Creating and communicating a bigger bolder vision of legacy beyond life of mine can demonstrate a company’s societal commitment.

Analysis: Top 10 risks and opportunities

1. Environmental, social and governance (ESG)

Many of the ESG risks raised in our survey this year are not new, but what is changing is a growing degree of both complexity and investor attention. We believe this will spur more innovation, more ambitious targets and greater transparency in reporting.

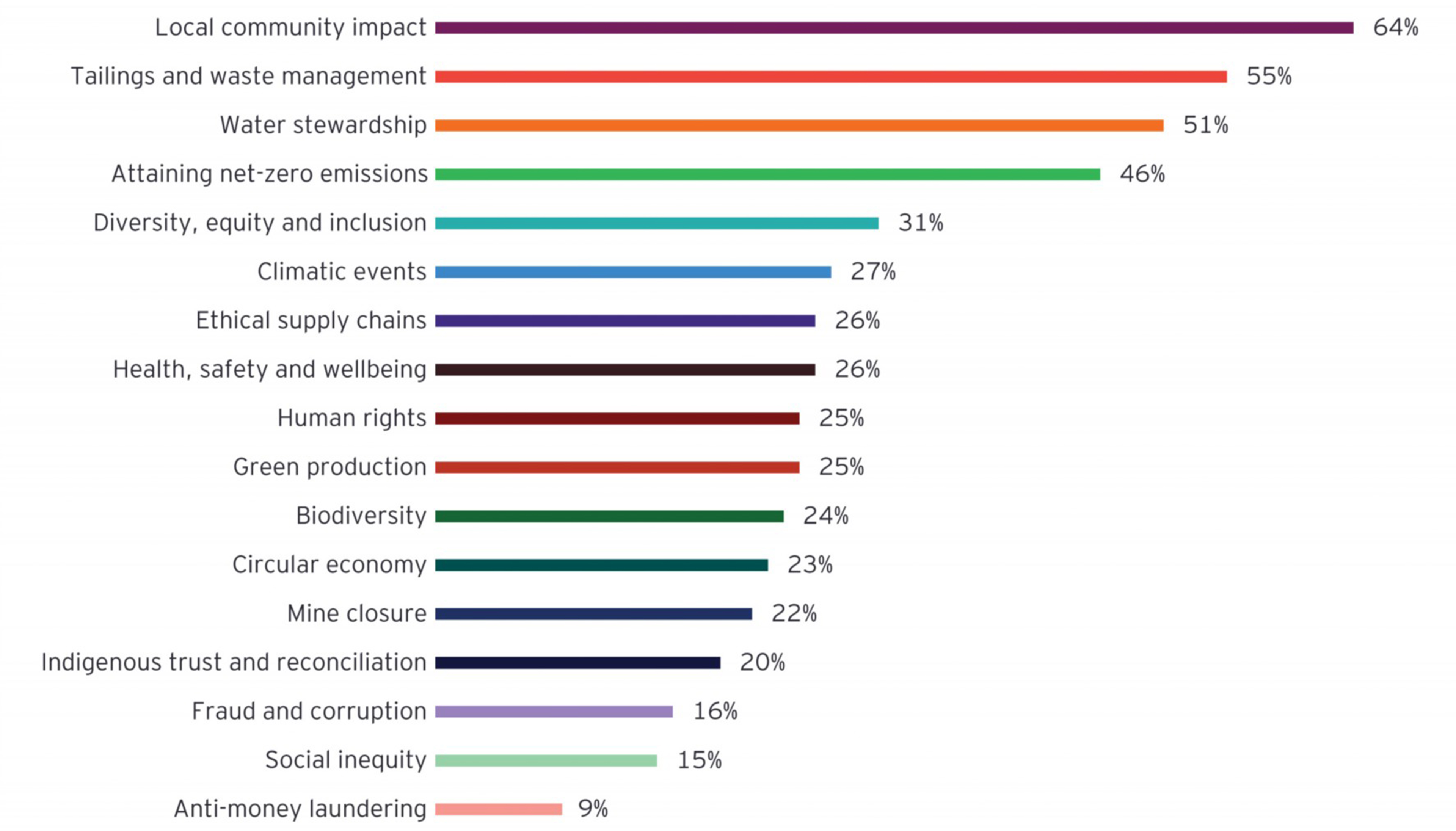

Which are the ESG factors facing the most scrutiny from investors in 2024?*

Source: EY mining and metals business risks and opportunities survey data 2024.

*Respondents could choose more than one option

Much of the challenge of ESG is the diversity of risks and opportunities at play. Companies are grappling with issues ranging from water stewardship to ethical supply chains and mine closure — all while trying to navigate what respondents describe as an “alphabet soup” of regulations and with ongoing data integrity challenges. Forty-one percent of miners surveyed said their digital priority was a platform to track and report ESG metrics. To avoid disclosure missteps and make the best use of resources, miners will need a better view of high-quality ESG data, with strong governance and controls in place to ensure appropriate sign-offs and processes.

2. Capital

The race is on to secure the huge investment in mining and metals required to meet growing demand for the minerals and metals critical to the energy transition, including copper, lithium and nickel. Markets are responding, but, as at 31 July 2023, capital raised through debt and equity this year has remained steady (US$178b compared with US$183b in the same period of 2022). It appears, therefore, that capital is moving to new commodity markets rather than solving what is already a significant risk.

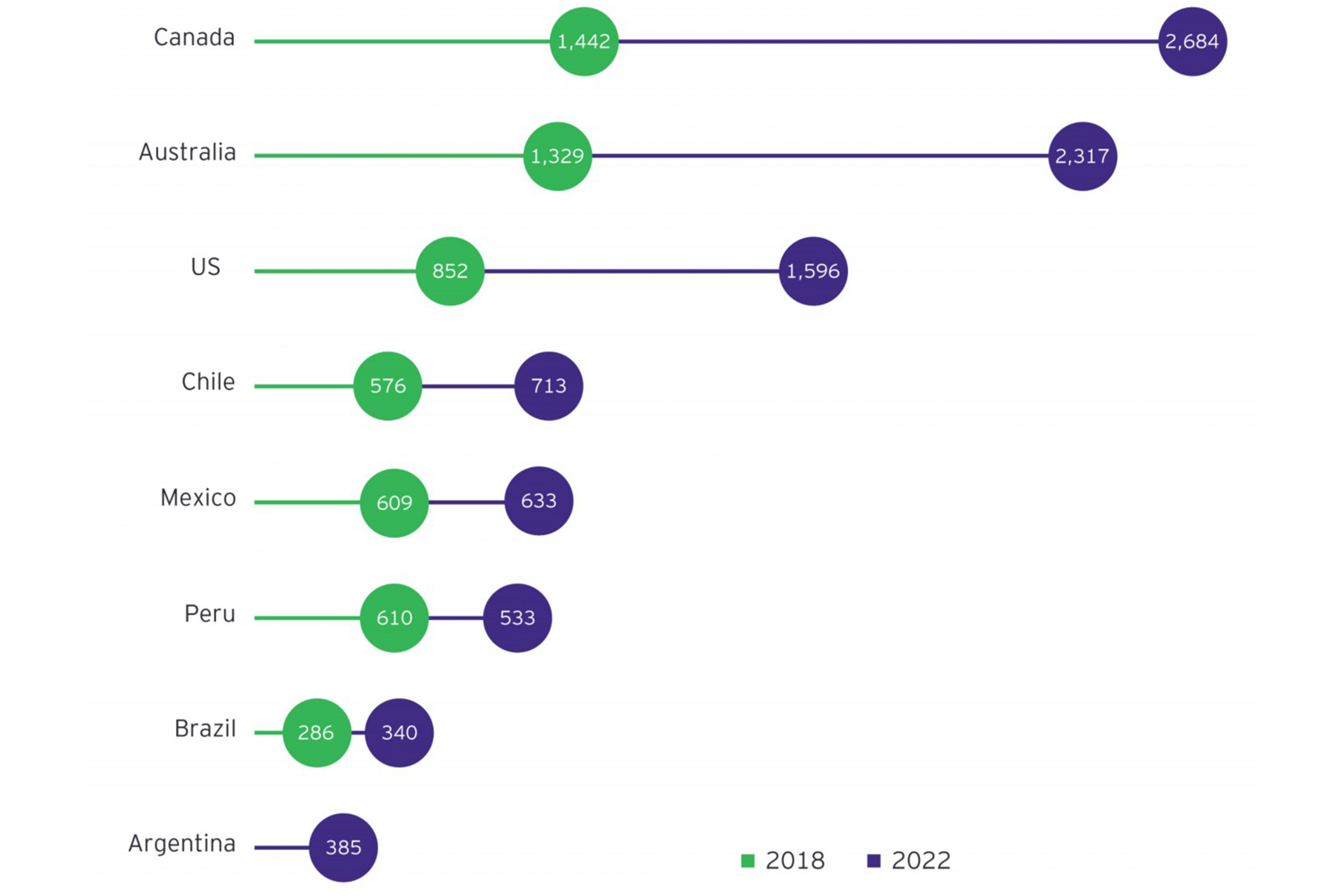

Iron and steel, gold, and coal companies continue to attract the most capital, but investment is increasing in nickel and lithium. Exploration budgets are on the rise, with the US, Canada and Australia the preferred destinations, due to their low risk rating.

Exploration budgets by destination 2018 vs. 2022 (US$m)

Source: EY analysis of S&P Global Market Intelligence data.

Across the sector, companies continuing capital discipline is reaping rewards — average shareholder returns by the top 30 miners have increased by CAGR of 22% over 2019 to 2022. However, miners will need to balance continued economic returns with more investment in digital, decarbonization and ESG. And as difficult decisions are made, bringing investors along on the journey will be critical.

3. LTO

Expectations of companies are growing, with people demanding they do more for the communities in which they operate. Sixty-four percent of survey respondents said community impact was the top ESG issue facing scrutiny from investors in 2024. Executives say their understanding of sustainability-related matters has increased significantly over the years — but now they realize they cannot tackle all matters at once. The big question is what to prioritize to create real and lasting impact. “License to operate is increasingly challenging, with a broadening range of stakeholders and issues — creating a long-term focus on value beyond life of mine and working with communities to co-develop solutions is key,” says Paul Mitchell, EY Global Mining & Metals Leader.

Actively engaging with communities to first understand, and then deliver, the value they need can help prioritize actions. Anecdotally, the miners with open, close communication with community leaders have more highly engaged employees and fewer strikes.

4. Climate change

Climate change is a complex issue for miners: They must both provide minerals for the energy transition, while also reducing greenhouse gas (GHG) emissions.

Net-zero initiatives are progressing across the sector, though some survey respondents admitted challenges in meeting interim targets. Many miners are forming ecosystems and partnerships to develop the technological innovation that can fast-track decarbonization. Government support and the falling cost of renewables are driving growth in renewable energy contracts and investment in solar or wind generation. Many miners are sourcing green electricity to decarbonize Scope 2 GHG emissions but find it hard to get green energy at scale.

Miners must also prepare and provision for the growing impact of climatic events on day-to-day productivity and health and safety. One Canadian miner affected by recent bushfires told us they are considering better preparations for future events: “We are asking, ‘Do we allocate two-day stoppages per annum to cater for climate change?’ It might not be a bad idea going forward.”

5. Digital and innovation

Leaders anticipate a surge of investment in data and technology, driven by demand across the business for digital solutions to reduce costs and improve productivity, safety and ESG outcomes. Survey respondents are excited by the potential of generative AI and are exploring other new technologies, particularly those that can optimize mineral recovery. Many are seeking greater collaboration and partnerships to help speed up transformation and drive innovation in the sector.

Miners are data rich, but many struggle to manage and capture insights from this wealth of information. And many lack an integrated approach to technology implementation, limiting the value it can bring to the business. As one CIO said, “As CIOs, we need to fall in love with the problem, not the solution. We need to put ourselves in the operator’s shoes, to truly understand their real situation, and be able to transform various aspects of their routine.” Technology adoption, and its success, differs between miners, with our research revealing that organizations that champion new technology at an operational level do best.

Source: Paul Mitchell

EY Global Mining & Metals Leader

11th October, 2023

afric-Invest

afric-Invest