Trade between Africa and China looks set to reach the targets offered in 2021; but what will it take to shift it toward value addition on the continent?

August 15th, 2024 Opinion by Rosie Wigmore Image : FADEL SENNA/AFP

In 2021, at the eighth Forum on China-Africa Cooperation (FOCAC), China pledged to import total African products worth $300bn over three years. This was not an overly ambitious target given that, based on Chinese import figures, Africa exported $275bn worth of goods to China between 2019 and 2021. Indeed, China has been Africa’s largest bilateral export destination since 2009. Nevertheless, it was still an important target because it was not only the first import target that China had set for Africa, it was also the first import target that had been set for Africa by any development partner.

A key reason for the target was to respond to African demands to reduce growing trade imbalances between Africa and China. To help reach the target, China also announced a range of supportive trade initiatives at FOCAC including $10bn worth of trade financing to boost African exports to China, “green lanes” to fast-track African agricultural exports to China, online shopping festivals to promote and sell African products in China and further increase the scope of African products enjoying zero-tariff treatment.

The good news for Africa is that this target is very likely to be met. Between January 2022 and June 2024, and again based on Chinese import figures, African countries have exported a total of $286bn worth of goods, meaning China has to import just an additional $14bn worth from Africa over the coming months to reach the target. From this perspective, the target has worked: it’s been a success.

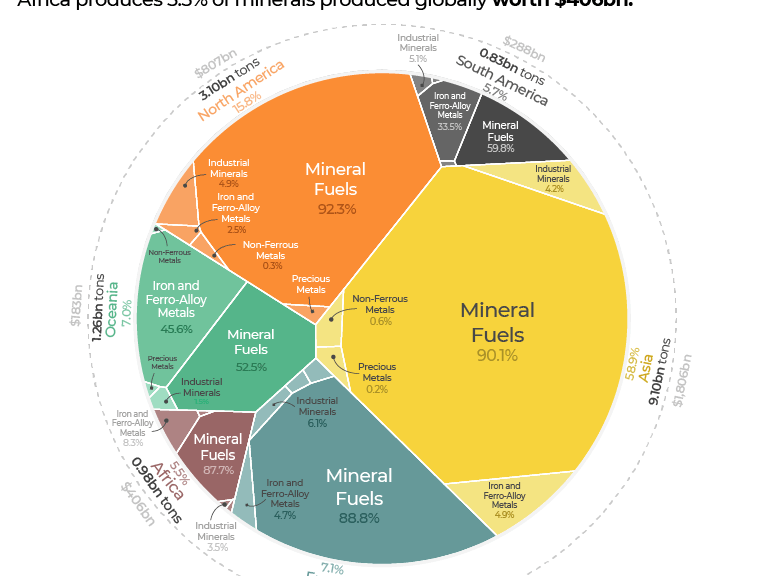

The bad news is that over the same period Africa’s trade deficit with China actually widened. For example, in 2021 the trade deficit was $39bn and by 2023 it was $63bn. Furthermore, while there was some diversification, in 2023 just nine African countries, all resource-rich countries, accounted for 83% of exports with China and this trend has continued into 2024.

How to build on trade success

So what can be done in the next iteration of FOCAC to build on the success while also recognising the shortcomings of the target? Continue reading After $300bn promise, what next for Africa’s exports to China? →

afric-Invest

afric-Invest