In the ever-changing African Eurobond market, Cyprus-based trader Simbarashe Jindu briefly pauses amid a busy trading day. Despite challenges posed by the 2020 pandemic and recent global political shifts, the secondary market for buying and selling African debt remains strong. It’s fuelled by Eurobond issuances from African governments and corporations, drawing in an international mix of brokers, traders, and asset managers. The market reacts quickly to information or speculation, often sparking swift trade surges to capitalise on opportunities or to reduce potential losses.“For lack of a better phrase, it can be like the Wild West,” says Jindu.

“It’s not a place where most people trade, because sub-Saharan Africa (SSA) is one of the more volatile spaces in the Eurobond market. But it attracts those looking for higher yields, as compared to other emerging market (EM) papers like Saudi Arabia, yields in SSA are 3% higher and more.”

Traders in African debt focus on the “spread” – the yield difference between these bonds and a benchmark, often US Treasury bonds. This metric is critical, spotlighting the perceived risk and potential return of investing in African debt versus the more stable, lower-yield US bonds. A wider spread indicates higher risk with possibilities of larger returns, while a narrower spread suggests lower risk and more modest returns.

“Some bonds are oversubscribed or underbought even during defaults. Such anomalies signal when a bond is trading much higher or lower than expected. By examining these specific bonds, traders can anticipate higher trading values post-restructuring. Ghana is trading low 40s to the dollar, but post restructuring those bonds might trade as much as 50, so that’s just a risk you’re taking,” says Jindu.

As global central banks begin to ease off their tightening cycles, a resurgence of interest in bonds is noticeable as borrowing costs lesson. Yet, formidable challenges persist, and the door to new issuance has remained shut for sub-Saharan Africa throughout 2023. Constrained by high interest rates, foreign exchange volatility, and persistent inflation, only Egypt and Morocco, habitual issuers in North Africa, have managed to raise global capital from the continent this year.

Eurobonds offer governments flexibility – in comparison to the decades of conditional loans – but they come with steep costs, high yields (5% to 18%), and shorter maturities, typically around 10 years.

This financial structure poses sustainability issues, with countries including Nigeria, Kenya, Angola, Egypt, and Ghana allocating a substantial portion of their tax revenues to interest repayments. In Nigeria, over 80% of federal revenue is consumed by debt repayments, a trend the IMF expects to reach nearly 100% by 2026.

Investor enthusiasm

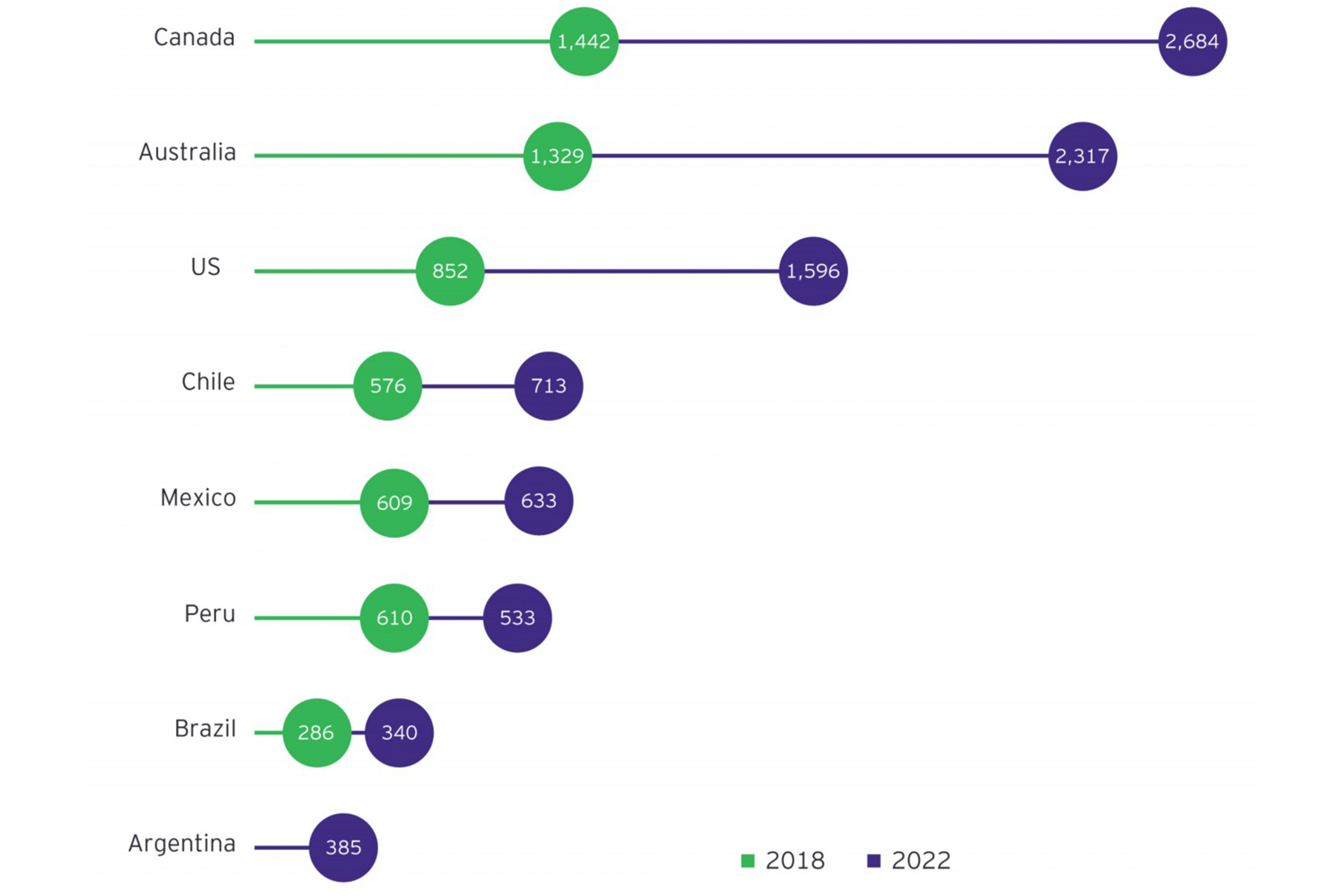

Since South Africa’s inaugural Eurobond issuance in 1995, the African Eurobond market has witnessed profound growth, with participation from over 21 countries by 2023. This expansion mirrors the continent’s urgent demand for capital to fuel infrastructure development and manage essential imports. As of the third quarter of 2023, the face value of African sovereign Eurobonds stood at $142bn, with a market value of approximately $125bn, illustrating the market’s robustness, says Gregory Smith, author of Where Credit Is Due, and lead economist at the World Bank.

Related articles

The market’s allure is further emphasised by investor enthusiasm. A survey conducted by The Value Exchange indicates that 76% of asset managers plan to increase their investments in African debt. This strong interest highlights the potential of the continent’s financial instruments.

Yet Africa’s Eurobonds present a complex narrative of both success and caution. While countries like Zambia and Ghana face ever-present challenges due to the misuse of capital amid global economic slowdowns and commodity price crashes, others like Rwanda demonstrate the positive impact these financial tools can have when managed effectively.

Rwanda’s inaugural Eurobond issuance in 2013, totalling a modest $400m, stands as a testament to fiscal responsibility, says Smith. This represented about 5.1% of its GDP at the time, a figure that has since declined to around 3% of its 2023 GDP, owing to the country’s steady economic growth.

The success of this bond is attributed to its transparent allocation of funds, with significant portions invested in the Kigali Convention Centre, RwandAir, and the Nyabarongo hydropower project. Despite global economic challenges, these projects have flourished, contributing to Rwanda’s infrastructure and economic development.

“There are a lot of lessons to be learned from this first round of borrowing from the continent,” Smith tells African Business. “My view is this hasn’t been a mistake, but accessing the markets has got to be done better. There are some countries who have borrowed too much like Ghana, which tapped the Eurobond market too heavily. And for others they didn’t align the use of proceeds to invest in specific projects.”

In 2021, Rwanda continued to show its adeptness in the market by issuing a second Eurobond for $620m at a lower interest rate, using part of the proceeds to refinance the initial bond, a strategic move that demonstrated the country’s growing sophistication in debt management.

The lessons from Rwanda’s experience are clear. Eurobonds, while offering significant development finance, demand prudent management. Missteps during times of crisis can lead to crippling debt, worsening credit ratings, and rising interest rates, potentially foreclosing future Eurobond issuances.

The story of Mozambique’s 2013 “tuna bond” serves as a stark reminder of the risks involved. Never paying a single coupon and eventually declared illegal, this bond, which was supposed to finance a tuna fishing fleet, led to a massive increase in the nation’s public debt – from less than 50% of GDP in 2013 to 140% by 2016. The situation was worsened by undisclosed government borrowing and graft. Today, Mozambique’s remaining Eurobond, maturing in 2031, has seen its coupon rate balloon from 5% to 9%, adding heavy weight to the annual interest burden.

Alternative funding sources

Now, with African countries confronting challenges in debt markets, some are actively seeking alternative funding sources.

Innovative financing methods, including social impact bonds, green bonds, and diaspora bonds, are being explored. This strategic shift aims to diversify funding mechanisms and reduce Eurobond dependency.

“I think some sovereigns are pivoting away or are having a pause from the Eurobond market, as they will have to do things a bit differently, maximising concessional lending, and for others it’s lesson is to use the markets a bit more widely and rethink the strategy,” says Smith.

“For those who haven’t got large maturities coming they can quite easily sit this one out and wait for the weather to change. If you have large maturities coming then you are going to have to come back to the markets or conjure up a plan B, and that’s what Kenya’s doing right now.”

Approaching the debt wall

At the year’s close, the maturity “debt wall” looms large, presenting itself as an intimidating impediment to development, with Zambia, Egypt, Ethiopia, Ghana, Kenya, and Tunisia facing pressing repayments in 2024 and 2025, amid economic strife.

Zambia’s $4bn debt restructuring, hindered by November’s creditor disagreements, highlights the limitations of Lusaka’s declining options in debt refinancing, while the price of copper, their primary export, remains stubbornly low.

Egypt, burdened with a $100m repayment obligation, grapples with fiscal pressures, while Ethiopia navigates restructuring under the G20 Common Framework amidst civil war and pandemic fallout.

Ghana, in the throes of its worst economic crisis, works towards restructuring $13bn in Eurobond debt after defaulting.

Kenya faces a potential crunch in June 2024 with a $2bn Eurobond due, as the government scrambles for relief through fiscal moderation. Tunisia’s economic crisis is compounded by imminent Eurobond maturity and challenging IMF negotiations.

For some of Africa’s debt issuers, it can look as if their foray into global capital market access has been the case of one step forward, and two steps backwards, with a return to the crippling debt crisis they battled at the turn of the century.

But for Yvette Babb, an EM fixed income portfolio manager at William Blair, an investment bank and investment management firm, the forecasts for debt restructuring and the fundamental health of the market is broadly optimistic.

“If you look at the African Eurobond space at an index level, so taking the JP Morgan EM bond index (EMBI) global diversified African spread levels as an aggregate, they clearly are on the higher side from a five-year perspective,” she says.

“We foresee 2023’s challenges evolving into 2024’s opportunities, especially in fixed income asset classes. Countries with major external financing needs, like Egypt and Kenya, are likely to see reduced refinancing concerns, thanks to support from development partners, both multilateral and bilateral. And in the broader context, SSA presents a generally positive risk-reward balance – the high spreads now appear to sufficiently, sometimes even overly, compensate for the risks associated with these countries abilities and intentions to repay Eurobond debts,” says Babb.

The financial landscape, once characterised by low global rates and narrow spreads before 2020, has transitioned to a tighter regime, yet one unlikely to replicate 2023’s severe tightening in 2024, according to Babb. This shift alleviates concerns over imminent debt maturities but highlights the necessity for structural changes in financing strategies. Anticipating more expensive commercial financing, these countries are now tasked with re-evaluating their borrowing approaches and costs, confronting limited access to commercial bond markets and escalating concerns about debt sustainability.

Despite these challenges, the continent’s trajectory isn’t solely defined by impending austerity. “We’ve seen remarkable growth and social progress in Africa over the last two decades, driven by reform and investment, with Eurobond markets playing a significant role,” says Smith.

afric-Invest

afric-Invest